NEWS

07 September 2017

Focus: market trend

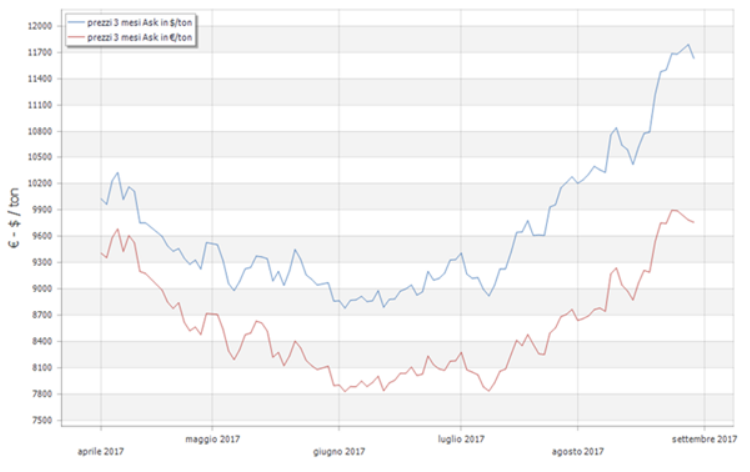

Consolidating the trend of the end of July 2017, the nickel quotation strengthened not a little during the summer time in August achieving the current amount of 11.700 dollars approximately with a steady value of the dollar within the limits 1.17-1.20. The following graphic accurately highlights the nickel price trend both in dollar and in euro, standing out the fact that from the minimum of mid-July the nickel price has raised more than 25%

The aforementioned event involves a total review of the forecast of the alloy surcharge values especially for October 2017, that is: for September the forecast for AISI304 alloy surcharge was €/ton 1.050-1.060. Actually the current values is €/ton 1.110 as recently announced. A small increase. Whereas for October the forecast for AISI304 alloy surcharge is around €/ton 1.230, therefore a clearer rise. Ultimately, from the “minimum” prices related to the projection of 1.050-1.060, as previously described, there could be an increase of about €/ton 180 if the current situation of the nickel trend persists. For the 316L the current alloy surcharge forecast for October is €/ton 1.750 (in mid-July it was about €/ton 1.480), therefore, in such case too, a significant increase.

No-stop rising trend for PP-PE-PS

In Europe, the rising trend in the PP and PE market had already increased before the ethylene and polypropylene agreements were signed with rises of €30/ton and €40/ton respectively, compared to August. Although the formal offers haven’t been completely announced yet, the first formal offers show notable increases in comparison with the monomers rises, as the sellers aim at recovering their own profits. The strong demand during the month of August, due to the fact that the PP prices had reached steady quotations and different buyers had stocked these materials, reinforces this rising trend. With reference to ChemOrbis Price Index, the PE spot prices in Europe got settled in August after 5 months of constant downward trend. Concerning the PP, the market have decreased for 4 months before raising in the second half of July and then stabilizing in August. In line with PE and PP, also the Polystyrene remains high and confirms the maximum values of the last period. The ChemOrbis Price Index data suggests that the PS and ABS import-markets of China and South-East Asia have reached the highest levels since March, in line with the recent increases supported by the costs.